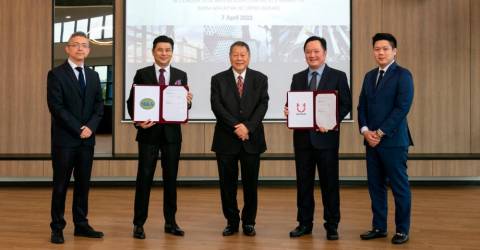

PETALING JAYA: Unitrade Industries Bhd has entered into an underwriting agreement with M&A Securities Sdn Bhd for its initial public offering (IPO) on Bursa Malaysia Securities Bhd’s ACE Market.

For its IPO, the building materials wholesalers and distributors plan to issue 312.5 million new shares, representing 20% of its enlarged share capital, as well as an offer for sale of 125 million existing shares.

Of the new shares, 78.1 million shares will be made available to the Malaysian public via balloting, 63.5 million shares to its eligible directors, employees, and persons who have contributed to its success (pink form allocation), 53.7 million shares for private placement to selected investors and the remaining 117.2 million shares will be placed out to bumiputra investors approved by the International Trade and Industry Ministry (Miti).

For the offer sale shares, the group has allocated 78.1 million shares to Miti-approved bumiputra investors and the other 46.9 million shares will be placed out to selected investors.

Under the agreement, M&A Securities will underwrite 141.6 million new shares for the Malaysian public and pink form allocations.

Unitrade managing director Nomis Sim Siang Leng is delighted to sign the underwriting agreement with M&A.

“The exercise comes with multifaceted benefits beyond the estimated proceeds to be raised,” he said in a statement, noting the exercise will enhance its brand as well as its credit and financing options.

Sim stated the group has recently consolidated its operations under a new industrial complex which houses its headquarters, warehouse, and factory facility.

“The new warehouse is measured at 281,000 sq ft and is double the size of our previous one, giving us the ready capacity to increase our inventories to meet the upcoming surge in demand for building materials,” he said.

“Accordingly, we will deploy a portion of the IPO proceeds to boost our working capital, allowing us to swiftly ramp up our volume and capitalise on the opportunities.”

Unitrade is slated to be listed by May this year with M&A as the adviser, sponsor, underwriters and placement agent for the exercise.